If your home has a history of subsidence, you may find it difficult to find an insurance company that will provide cover if it occurs again. The alternative is to use a specialist insurance provider that can provide protection for your property, so you have long-term financial security.

Previous Subsidence Home

Horner Blakey

Insurance Brokers

What is insurance for homes with previous subsidence?

Insurance for homes with previous subsidence is a specialist policy designed for properties that have a history of subsidence. While most home insurance policies will provide cover for subsidence, this does not usually extend to properties that have reported it in the past. It means you have cover against the various factors that can cause subsidence, should it occur again in the future.

Do I need insurance for homes and properties with previous subsidence?

If your property has suffered with subsidence before, there is a chance it could return and cause damage to your property again in the future.

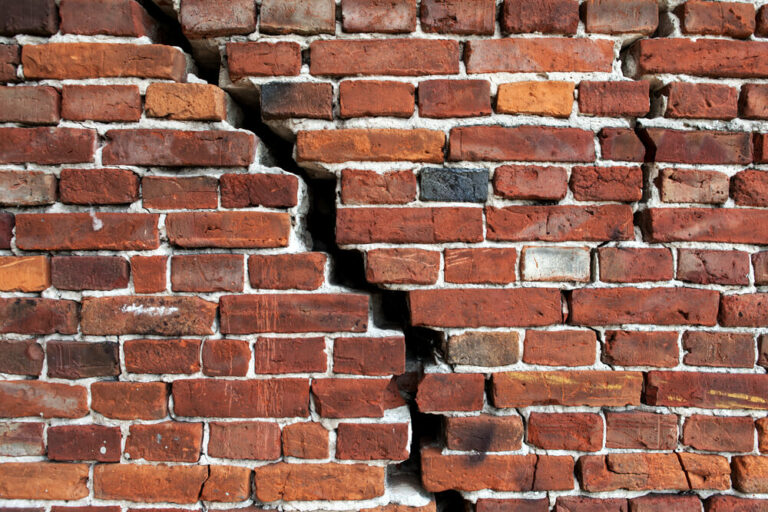

There is no single reason why subsidence occurs, and it can be caused by several factors, such as:

- Soil moisture: Clay soil in particular tends to shrink, and swell based on the amount of moisture content that is present.

- Trees and vegetation roots: Tree and shrub roots looking to extract water from the soil can expand to affect the property structure during dry spells.

- Leaking drains: Damaged drains can cause the ground to gradually wash away under the foundations of the property.

Subsidence can wreak havoc with the structure of the property, which can not only affect your quality of life at home but can also be very expensive to repair. It makes financial sense to take out insurance to protect your property, especially if it is an issue you have had to deal with before.

Can I get insurance for my home if it has a history of subsidence?

If you already have subsidence cover but wish to change your insurance provider, you should first confirm that they will review the past subsidence incident at the property.

You will be required to submit an up-to-date surveyor’s report and information about any previous claims made, which will enable the insurance company to benchmark the condition of the property.

Horner Blakey works with specialist providers who can provide insurance cover based on your circumstances, even if your property has a history of subsidence.

We also advise that clients always read the full details of your individual policy before proceeding with an agreement, as terms and conditions will apply.

What does subsidence insurance cover?

While policies vary depending on your circumstances, subsidence insurance can provide cover for:

- Repairs to your home due to damage caused by subsidence

- Moving and living in alternative accommodation if needed while repair work is carried out

Many large insurance companies will not provide cover for homes with previous subsidence issues, which can make things difficult if there is a history of it at your property. Using a specialist insurer can sometimes cost a little more, but it ensures you have peace of mind that you can make a claim that has a higher chance of being successful.

Horner Blakey can connect you with the right insurance provider for your home, taking into account your claims history, property type and budget, so you can choose what works best for you.

Please click the link below to discuss your circumstances:

What is subsidence -Frequently asked questions click here

View our most frequently asked property insurance questions.

View our Landlords A-Z of useful terms.